Saving money doesn’t have to mean giving up the things you enjoy. With a few smart strategies, you can embrace the top ways to save money without sacrificing your lifestyle. By making small adjustments, you can reduce expenses while still enjoying the comforts and experiences that make life fulfilling.

Whether it’s meal prepping at home, shopping smart with discounts, or using energy-efficient appliances, these money-saving tips allow you to live well without overspending. It’s all about balancing your budget while maintaining the quality of your everyday life.

Ready to take control of your finances while still living your best life? Here are the top 10 ways to save money without sacrificing your lifestyle—simple, practical, and effective steps to help you enjoy more for less!

1. Create a Budget and Stick to It

Start by creating a realistic budget that tracks your income and expenses. Use apps or spreadsheets to monitor your spending habits. Identify areas where you can cut back without compromising on your essentials, like switching to generic brands or reducing subscription services.

Budgeting helps you stay in control of your finances and plan ahead. It’s a simple yet effective way to save money without feeling deprived of your lifestyle’s comforts.

2. Meal Prep and Cook at Home

Eating out frequently can add up quickly. Save money by meal-prepping and cooking at home. Plan your meals for the week, buy ingredients in bulk, and prepare your lunches and dinners in advance to avoid expensive takeout.

Cooking at home not only saves money but also allows you to eat healthier and experiment with your favorite recipes. Make it a fun family activity or a chance to try new dishes.

3. Cancel Unused Subscriptions

Audit your monthly subscriptions and cancel those you no longer use or need. Whether it’s a streaming service, gym membership, or magazine, eliminating unnecessary expenses can save you hundreds each year.

This simple step helps you focus on the services and experiences you truly enjoy, without wasting money on things you don’t use.

4. Shop Smart with Discounts and Coupons

Take advantage of sales, discounts, and coupons when shopping for groceries, clothes, or household items. Use cashback apps or loyalty programs to maximize savings while buying the things you love.

Shopping smart doesn’t mean cutting back on quality—it just means making your money work harder for you.

5. Use Energy-Efficient Appliances

Save on utility bills by switching to energy-efficient appliances and LED lighting. These upgrades reduce electricity and water usage, lowering your monthly costs while being eco-friendly.

Small changes like unplugging devices when not in use or washing clothes in cold water can also make a big difference over time.

6. Embrace DIY Projects

Instead of paying for services, try DIY solutions for simple home repairs, decor, or hobbies. From painting a room to building your own furniture, embracing DIY saves money and allows you to learn new skills.

You can also personalize your space or wardrobe creatively while keeping your expenses low.

7. Buy Second-Hand or Rent Instead of Buying

Consider buying gently used items like furniture, electronics, or clothes from thrift stores or online marketplaces. For occasional needs, renting items like tools, party equipment, or even designer wear can save a lot of money.

Second-hand shopping is sustainable and cost-effective, allowing you to enjoy quality goods at a fraction of the price.

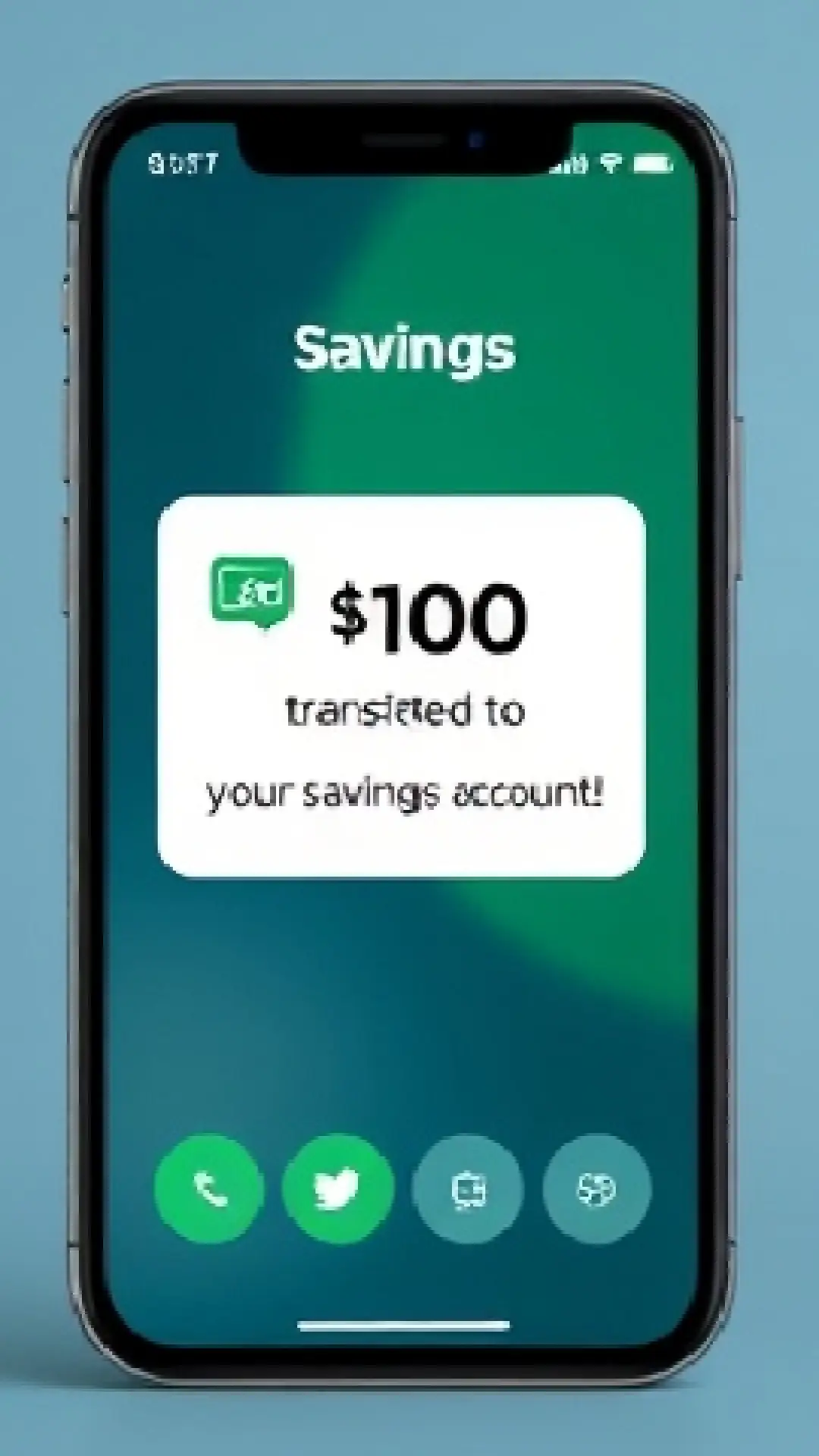

8. Automate Your Savings

Set up an automated transfer to a savings account each month. Treat it like a fixed expense to ensure you save consistently without thinking about it. Even small amounts add up over time.

Automation helps you build your savings effortlessly while still enjoying your current lifestyle, as the process works in the background.

9. Use Public Transportation or Carpool

Cut down on fuel and maintenance costs by using public transportation, carpooling, or biking for your daily commute. Many urban areas offer affordable transit options that save money and reduce your carbon footprint.

This eco-friendly tip also gives you time to relax, read, or enjoy podcasts during your commute.

10. Focus on Experiences, Not Things

Spend less on material goods and more on experiences like family outings, picnics, or road trips. Memories last longer than items, and many activities can be done affordably or for free, like hiking or visiting local attractions.

Shifting your focus to experiences enriches your life without adding financial stress, helping you enjoy more with less.

Living smart doesn’t mean giving up the things you love. These top ways to save money without sacrificing your lifestyle prove that you can enjoy life’s pleasures while staying financially savvy. Small changes, like meal prepping or automating savings, can have a big impact without compromising your happiness.

By implementing these money-saving tips, you’ll find it easier to manage your budget while still prioritizing the things that matter most. Start saving smarter today and enjoy a balanced lifestyle filled with comfort, fun, and financial stability! 💸